RETIREMENT PLANNING THAT'S UNDERSTANDABLE!

A FIRSTA FIRST

PRINCIPLEPRINCIPLE

APPROACH TOAPPROACH TO

RETIREMENTRETIREMENT

PLANNINGPLANNING

YOUR FINANCIALYOUR FINANCIAL

PROFESSIONALPROFESSIONAL

SHOULD HELPSHOULD HELP

YOU FILTERYOU FILTER

THE NOISE OFTHE NOISE OF

POLARIZINGPOLARIZING

OPINIONS.OPINIONS.

If you're worried about your account balance, you may postpone the trips you always dreamed of taking in retirement.

The Gestalt Method planning process helps you transition from being confused and worried to Empowered!

Freedom to spoil the grandkids.

Focus on the adventure, not your account balance.

Discover What's Possible!

Discover NowWhat We'll Achieve Together

- Identify the amount of assets needed for lifetime income.

- Discover Tax-Saving Opportunities.

- Deploy Excess Cash Flow to create the “Gestalt Effect.”

- Align your Wishes with your Estate Plan.

A Gestalt Method Retirement Plan Includes:

-

Retirement Income Wheel:

• Align Expenses with Income Sources -

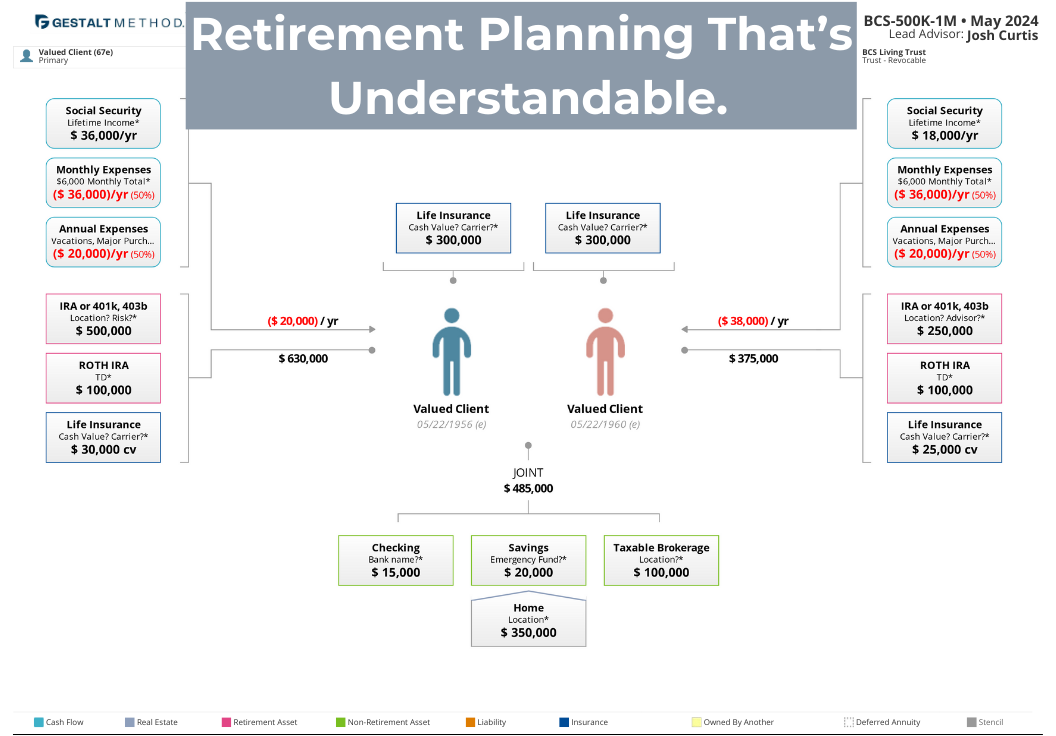

Asset-Map:

• Your One-Page Financial Picture -

Tax-Map:

• Identifies Tax-Savings Opportunities -

Fi360 Investment Monitoring Reports:

• Guides us for when funds need to be re-evaluated. -

Scheduled Client Review Meetings:

• Regular review meetings are crucial part of a successful financial plan.

History of The Gestalt Method

The foundational principles of the Gestalt Method are not new; several have existed for centuries. However, the innovative application of these principles to modern financial planning is what sets the Gestalt Method apart.

In 2013, investment advisor representative Josh Curtis began exploring ways to incorporate what he called the “first principles of retirement income” into a comprehensive planning process. He discovered these core ideas by applying First Principle Thinking, a critical thinking model attributed to Aristotle, to the problem of retirement income. The goal was to find a process that could transcend polarizing opinions, reduce information overload, and empower clients to make crucial financial decisions. First Principle Thinking enabled him to distill retirement income to its basic elements and resulted in the financial planning process now known as “The Gestalt Method.”

This method was named “Gestalt” because that's how we want to define our client's financial plan. Gestalt is a German word meaning “shape or form.” In English, it is used to describe something organized in a way that the whole is more than the sum of its parts. This is what we call the Gestalt Effect. We believe the Gestalt Effect can be discovered in a financial plan by applying the first principles of retirement income and then matching appropriate financial products with the client's financial goals.

The Gestalt Method of financial planning is now offered through a select network of independent financial professionals nationwide. All financial professionals who offer “The Gestalt Method” must complete specialized training. These financial professionals also have access to Gestalt's robust support resources to serve your ongoing financial planning needs.